nevada estate tax rate

NRS 3614723 provides a partial abatement of taxes. The federal Estate Tax has a progressive rate that starts at 18 and can reach up to.

Taxes In Nevada U S Legal It Group

What is the Property Tax Rate for Las Vegas Nevada.

. Nevadas property tax rates are among the lowest in the US. 2020 rates included for use while preparing your income tax. Meaning a homeowner wont ever see an increase in property tax of more than three percent.

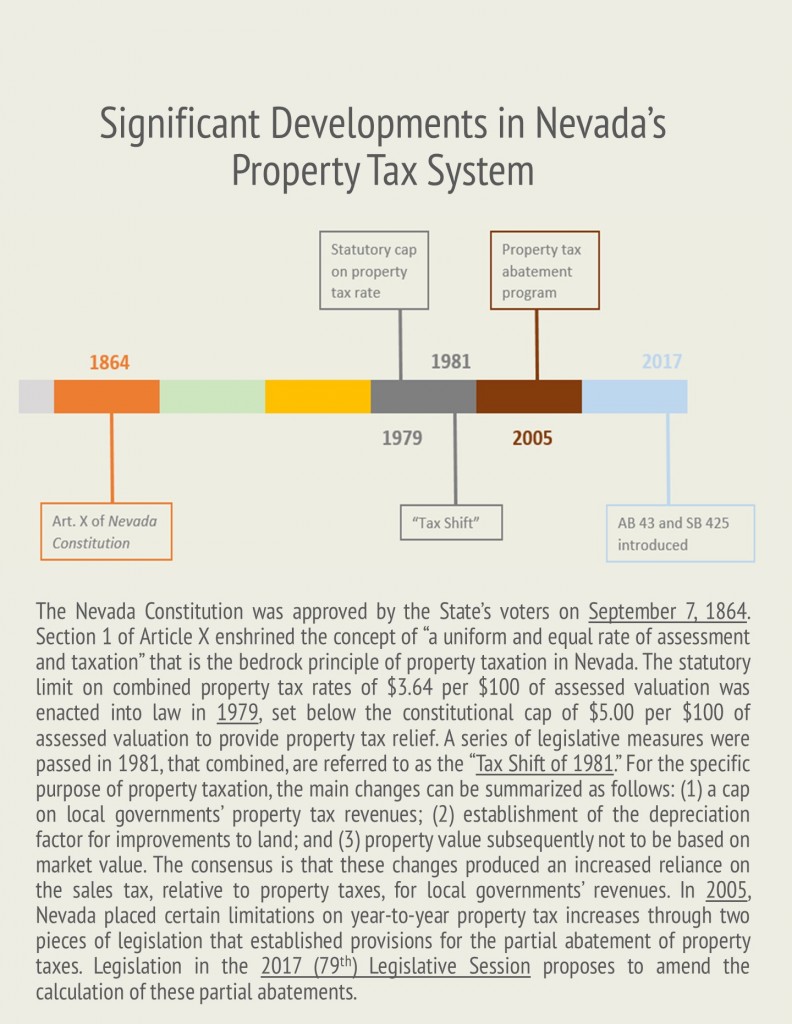

The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments. Learn all about Nevada real estate tax. So even though Nevada does not.

Some counties in Nevada such as Washoe and Churchill add 010 to the rate. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. If real property is.

Please verify your mailing address is correct prior to requesting a bill. No estate tax or inheritance tax. In Nevada the market value of.

The median property tax in Nevada is 174900 per year based on a median home value of 20760000 and a median effective. Nevada does not have an individual income tax. Counties cities school districts special districts such as fire.

Real Estate Tax Rate. The 2022 state personal income tax brackets. As Percentage Of Income.

Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. Right now the tax cap in our state is at three percent for a primary home. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005.

An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation. Before the official 2022 Nevada income tax rates are released provisional 2022 tax rates are based on Nevadas 2021 income tax brackets. In Nevada the median property tax rate is 572 per 100000 of assessed home value.

Nevada does not have a corporate income tax but does levy a gross receipts tax. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. The states average effective property tax rate is just 053 which is well below the national average of 107.

For more information contact the. 31 rows The latest sales tax rates for cities in Nevada NV state. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates.

No estate tax or inheritance tax. Nevadas statewide real property transfer tax is 195 per 500 of value over 100. Counties in Nevada collect an average of 084 of a propertys assesed fair.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. Nevada Property Tax Breaks for Retirees No property tax breaks are offered for seniors. Whether you are already a resident or just considering moving to Nevada to live or invest in real estate estimate local property tax rates and learn.

You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. Nevada has a 685 percent state sales tax rate a max local. Tax bills requested through the automated system are sent to the mailing address on record.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Here is a list of states in order of lowest ranking property tax to highest. Rates include state county and city taxes.

How Do State And Local Sales Taxes Work Tax Policy Center

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Property Taxes In Nevada Guinn Center For Policy Priorities

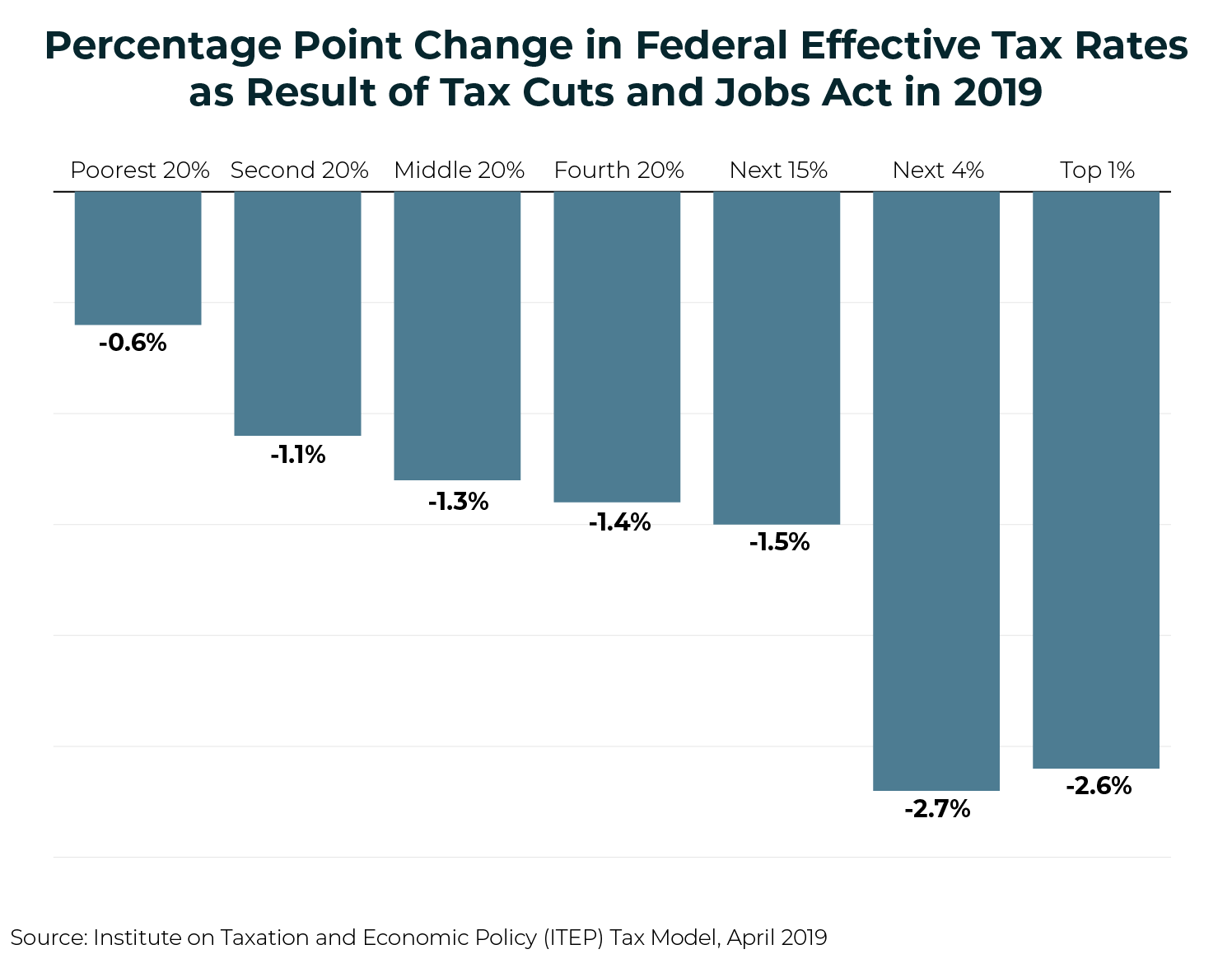

Who Pays Taxes In America In 2019 Itep

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Taxes In Nevada U S Legal It Group

City Of Reno Property Tax City Of Reno

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

Property Taxes In Nevada Guinn Center For Policy Priorities

2022 Property Taxes By State Report Propertyshark

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation